Some Of Mileagewise - Reconstructing Mileage Logs

Table of ContentsSome Known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs More About Mileagewise - Reconstructing Mileage Logs3 Simple Techniques For Mileagewise - Reconstructing Mileage LogsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsThe Basic Principles Of Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneUnknown Facts About Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Range function recommends the quickest driving course to your employees' destination. This feature improves productivity and contributes to cost savings, making it an essential property for services with a mobile workforce. Timeero's Suggested Path attribute further boosts liability and efficiency. Workers can contrast the suggested path with the actual path taken.Such a method to reporting and compliance streamlines the usually complex job of taking care of gas mileage expenditures. There are several advantages connected with utilizing Timeero to maintain track of gas mileage.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

With these devices in use, there will certainly be no under-the-radar detours to increase your reimbursement costs. Timestamps can be located on each mileage entry, boosting trustworthiness. These additional confirmation procedures will certainly keep the IRS from having a factor to object your mileage documents. With precise gas mileage tracking innovation, your staff members don't need to make harsh gas mileage price quotes or also worry about mileage expense tracking.

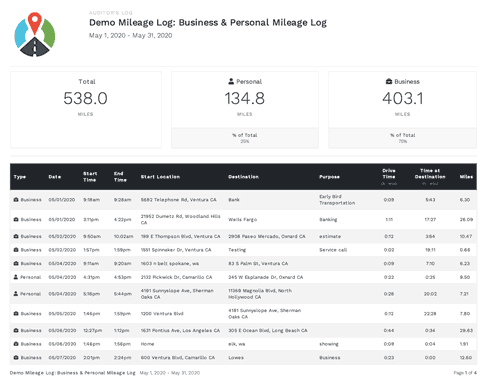

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all auto expenditures. You will certainly require to proceed tracking mileage for work even if you're using the real cost approach. Maintaining mileage records is the only means to different service and individual miles and give the evidence to the IRS

The majority of gas mileage trackers allow you log your trips manually while calculating the range and repayment quantities for you. Many also included real-time trip monitoring - you need to start the app at the beginning of your trip and stop it when you reach your final location. These applications log your start and end addresses, and time stamps, in addition to the total range and compensation quantity.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

One of the concerns that The IRS states that lorry costs can be thought about as an "regular and essential" expense throughout doing company. This consists of prices such as gas, upkeep, insurance coverage, and the lorry's depreciation. For these costs to be thought about insurance deductible, the lorry ought to be made use of for service objectives.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

In in between, vigilantly track all your organization trips keeping in mind down the starting and finishing readings. For each journey, document the area and organization function.

This consists of the total organization mileage and complete mileage accumulation for the year (service + individual), trip's date, destination, and purpose. It's necessary to videotape activities immediately and preserve a synchronic driving log detailing date, miles driven, and business function. Below's just how you can boost record-keeping for audit objectives: Beginning with guaranteeing a thorough gas mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

The actual costs technique is a different to the typical gas mileage rate method. As opposed to calculating your deduction based upon a predetermined price per mile, the actual costs technique enables you to subtract the actual expenses connected with using your vehicle for company purposes - mileage tracker app. These expenses include gas, upkeep, repair work, insurance coverage, depreciation, and various other associated expenses

Those with substantial vehicle-related expenses or special conditions might benefit from the real expenditures approach. Inevitably, your picked method ought to straighten with your certain financial objectives and tax scenario.

9 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown

Maintaining track of your gas mileage manually can require persistance, however bear in mind, it could conserve you money on your tax obligations. Follow these steps: Document the date of each drive. Tape-record the complete gas mileage driven. Think about noting your odometer analyses before and after each trip. Write down the starting and ending factors for your trip.

All about Mileagewise - Reconstructing Mileage Logs

And now almost everyone uses General practitioners to obtain around. That means virtually everybody can be tracked as they go about their organization.

Comments on “The Only Guide for Mileagewise - Reconstructing Mileage Logs”